jersey city property tax assessment

Mayor Fulop Announces Open Applications for Jersey Citys First Time Homebuyer Program to Assist Low and Moderate-Income Families. Online Inquiry Payment.

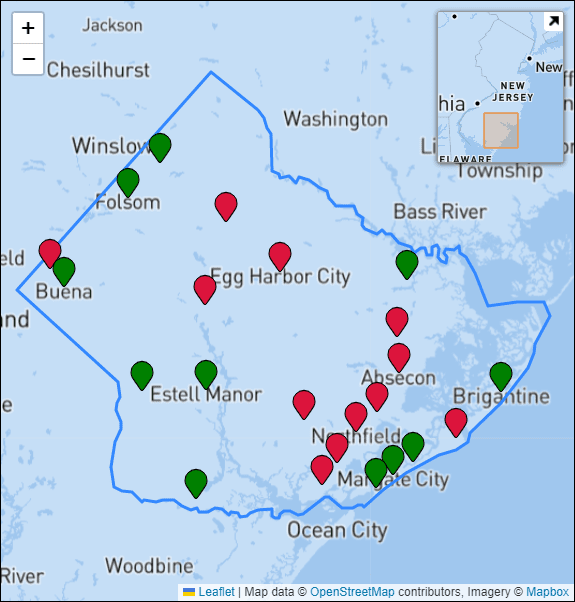

Atlantic County Nj Property Property Tax Rates Average Tax Bills And Residential Assessments

Left click on Records Search.

. Jersey City has finalized the 2022 tax rate and it represents an unprecedented increase of 32 from its 2021 tax rate. 2019 Agendas Minutes Ordinances. Online Inquiry Payment.

You can call the City of Jersey City Tax Assessors Office for assistance at 201-547-5132. Open Public Records Act. Jersey County Property Tax Inquiry.

Taxation of real property must. THE OFFICE OF THE CITY ASSESSOR SHALL. The average homeowner in New Jersey currently pays roughly.

2020-2022 Agendas Minutes and Ordinances. Remarkably it is estimated that the. Last item for navigation.

A 695 million city budget that would have raised taxes by 1000 to the average home assessed at 460000 was introduced in June. 2022 Jersey City Art Studio Tour - JCAST. City of Jersey City.

Property Tax Relief Programs. The Automated City Register Information System ACRIS allows you to search property records and view document images for Manhattan Queens Bronx and Brooklyn from 1966 to the. TO VIEW PROPERTY TAX ASSESSMENTS.

Tax amount varies by county. 11 hours agoRight off the bat this is significant and direct property tax relief for roughly 12 million New Jersey households. 1 be equal and uniform 2 be based on present market value 3 have a single.

To search for tax information you may search by the 10 digit parcel number last name of property owner or site address. This is where the city appraises the value of your property and determines the amount of tax you owe. Account Number Block Lot Qualifier Property Location 1073 15901 00023 153.

11 rows City of Jersey City. The median property tax in New Jersey is 189 of a propertys assesed fair market value as property tax per year. Account Number Block Lot Qualifier Property Location 18 14502 00011 20.

JERSEY CITY NJ 07302 Deductions. Under Tax Records Search select. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

TAXES BILL 000 000 49425 0 000 2036 3. The main function of the Tax Assessors Office is the appraisal and evaluation of all land and buildings within the municipality for tax purposes according to state statutes. Last month it ballooned to 7248 million.

For your convenience property tax forms are available online at our Virtual Property Tax Form Center. Department of Revenue Finance. The office of the City Assessor shall be charged with the duty of assessing real property for the purpose of general taxation.

New Jersey has one of the highest average. It is official. Jersey City is paying property tax through a process called assessment.

For more information please contact the Assessment Office at 609-989-3083. The states laws have to be abided by in the citys management of taxation. Department of Revenue Finance.

Fulop S Spokesperson Wrong On Property Tax Appeals Logic Civic Parent

Jersey City Commercial Property Owners Targets Of Property Tax Increase Cases Skoloff Wolfe

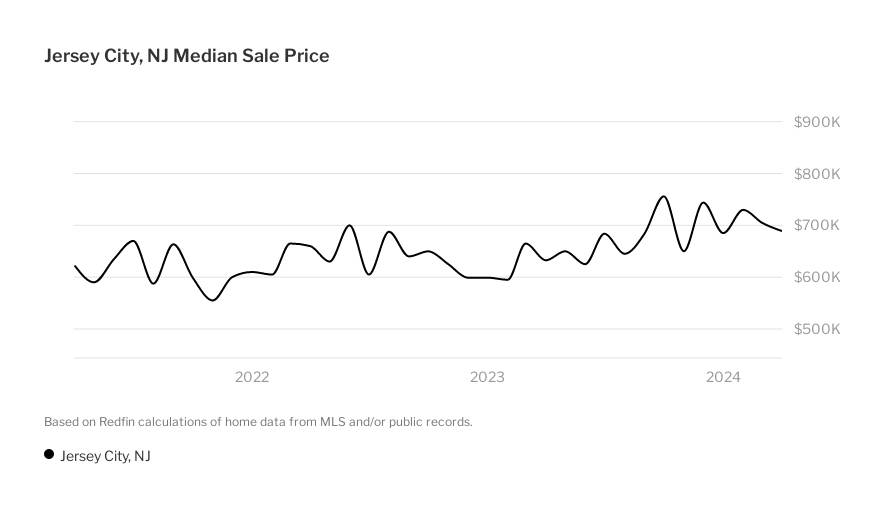

The Jersey City Real Estate Market Stats Trends For 2022

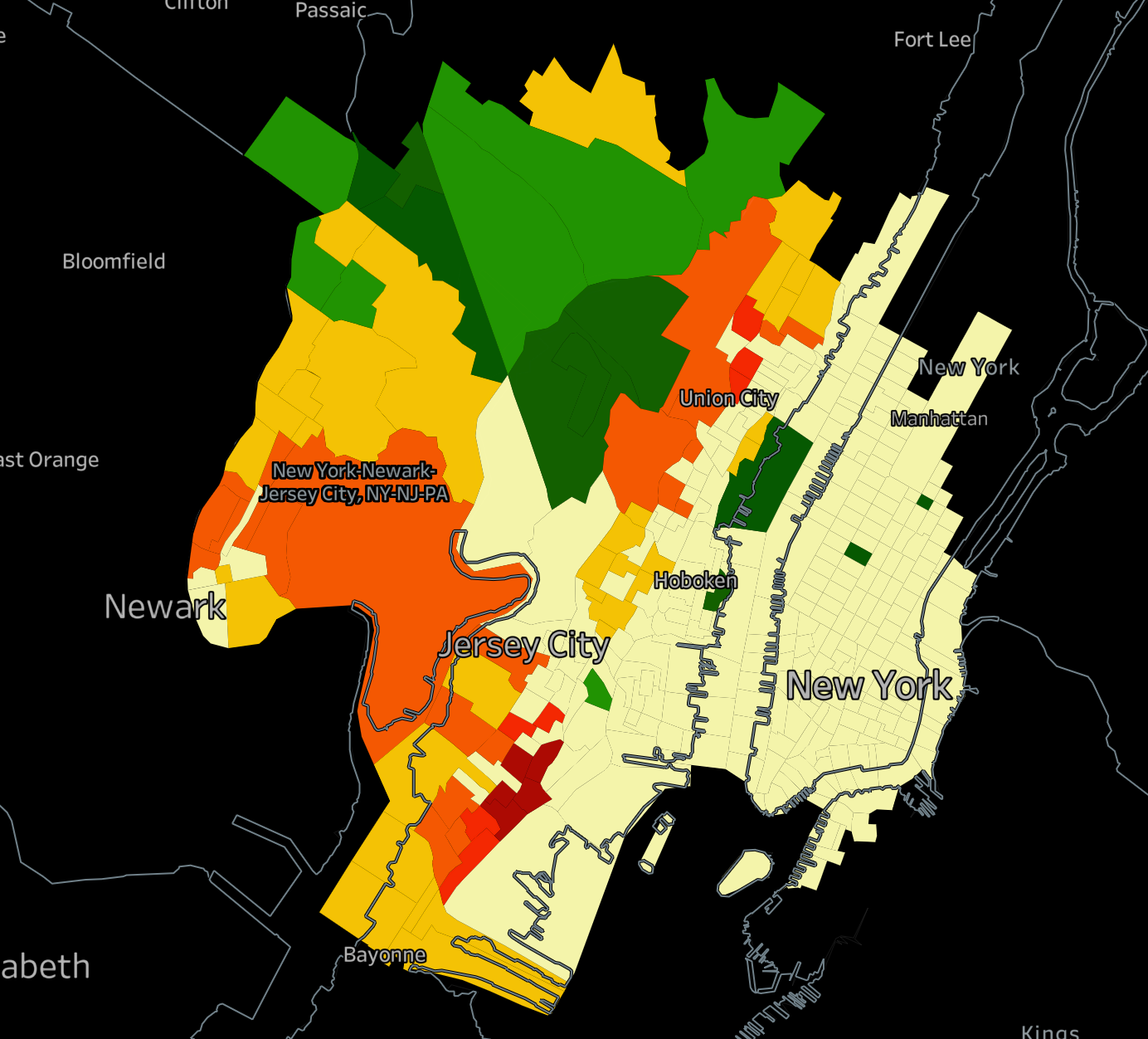

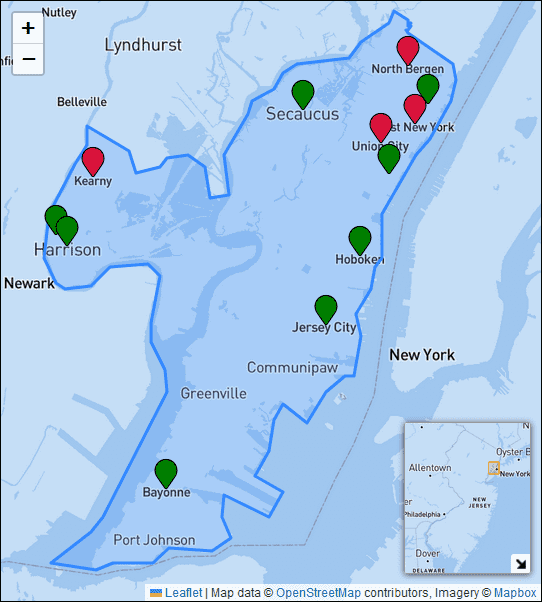

Property Tax Rates Average Tax Bills And Average Home Valuations In Hudson County New Jersey

Best Cheap Homeowners Insurance In Jersey City Bankrate

Tax Collector S Office City Of Englewood Nj

Here Are The 30 N J Towns With The Lowest Property Tax Bills Nj Com

1214 North 5th Street Philadelphia Pa 19122 Compass

Jersey City Housing Market House Prices Trends Redfin

Atlantic County Nj Property Property Tax Rates Average Tax Bills And Residential Assessments

Njactb Welcome To The Official Website Of The New Jersey County Tax Boards Association

50 Counties With The Highest Lowest Property Tax Assessments Cheapism Com

How Do State And Local Property Taxes Work Tax Policy Center

New Jersey Education Aid Jersey City S Property Taxes Are State S Most Unfair Is Anyone Surprised